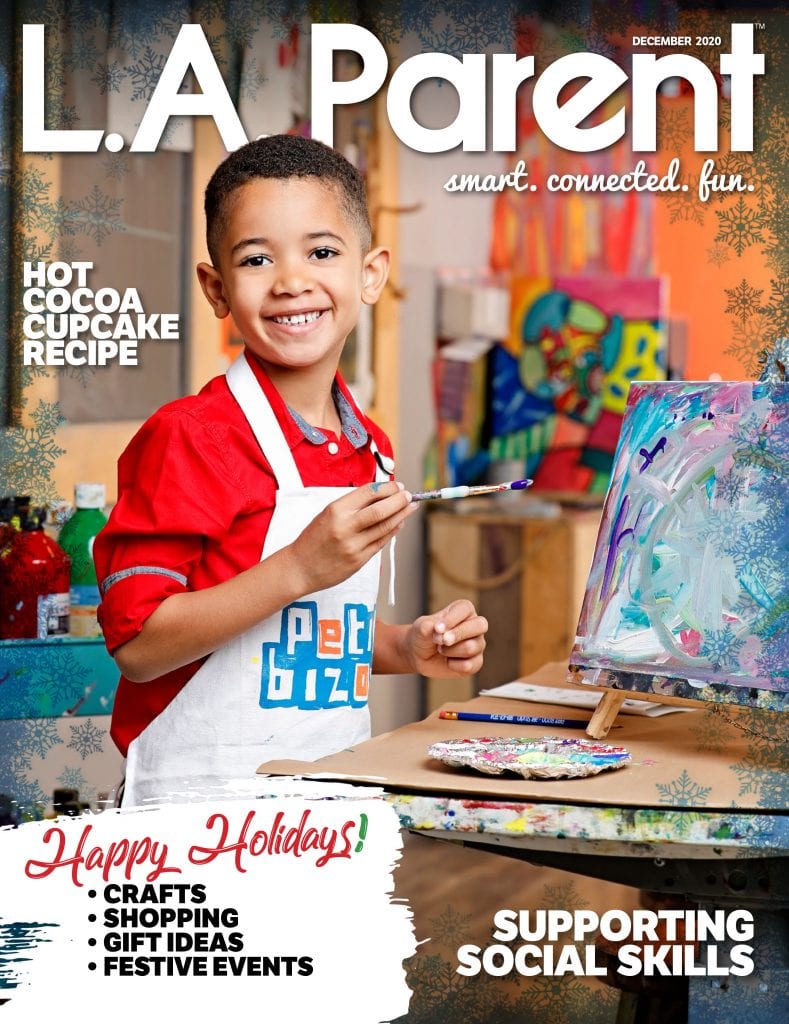

Sunny Lee with her husband, Thomas, and twin sons, Jason and Matthew, was inspired by her parents’ financial struggles. PHOTO COURTESY SUNNY LEE

Sunny Lee, the youngest of four children, grew up in a small village in South Korea. Watching her parents, factory and construction workers, scrimp to just barely meet their basic needs, Lee decided early on that she would use education, hard work and sheer determination to become financially independent. The Rancho Palos Verdes resident began her career as a journalist and later became a financial advisor. Her vigilance about money management became even more profound when her twin boys were born 12 years ago. The connection between hard work and earing money, saving and investing is woven into the fabric of Lee’s parenting. She also volunteers her time to teach financial literacy to students in inner-city L.A. schools. In her new book, “Is Your Child a Money Master or a Money Monster?” she writes about her methods for motivating kids toward financial success. Her approach to money lessons includes an allowance chart, incentive and finance book projects, family meetings to set and evaluate specific goals and a four-badge reward system.

What’s your biggest wish for your sons in regards to money?

To instill in them the value of working hard, finding a purpose and having the self-discipline to reach their goals. I want them to feel rich in the sense of their accomplishments. Our greatest mission as parents is to equip our children for the world. Teaching our children to manage their money is one of the greatest gifts we can give them.

You present an intricate system of tying chores, money, responsibility and motivation together. Did you ever think, “This is too much for kids”?

I did, and I know many readers will feel overwhelmed at first, but I look at the big picture. Teaching your kids about money is the same as teaching your kids to ride a bike or to swim. You have to do it step by step, and you have to start at a young age. Parents are their children’s biggest influence, and it is our job to plant the seed of financial well being.

What are your top money principles for your sons?

Money is earned, not given. Money is a vehicle to make our lives comfortable and enjoyable. You become rich by adding value to others. Share with others.

You write about developing a “money mindset.” Tell us about that.

Money mastery begins with our thoughts. If you have positive thoughts about money—that there is enough of it for everyone and that being financially secure is not about luck or fate, but directly related to your hard work—then you begin to have control over your money.

How can parents be good money role models?

Our children are watching us, copying us. They notice all the little things. We have open conversations with our boys about money and how we allocate our money for different things. We talk about our retirement savings and college savings and donating to our church. We are very transparent about our financial decisions. Parents shouldn’t be afraid to talk to their kids about money.

For more resources, tools and videos from Sunny Lee and her twin boys, visit www.nomoneymonster.com.