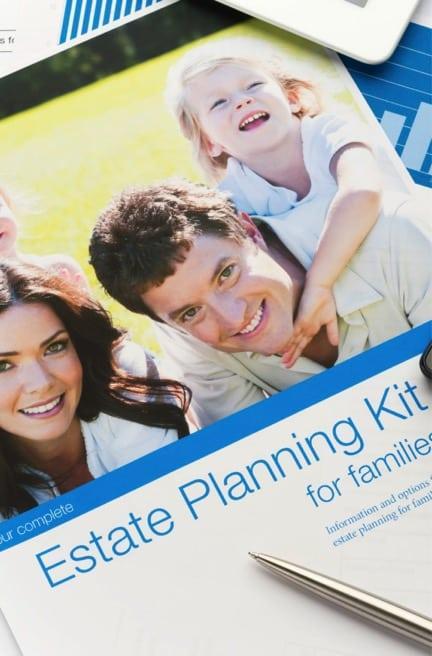

Estate planning is a task that is neglected by many parents. But in families that include children with special needs who will need long-term care and resources beyond their parents’ lifetime, it is a task that can seem especially daunting. Even something as wonderful as an unexpected financial windfall can have unforeseen – and devastating – consequences for these children.

Estate planning is a task that is neglected by many parents. But in families that include children with special needs who will need long-term care and resources beyond their parents’ lifetime, it is a task that can seem especially daunting. Even something as wonderful as an unexpected financial windfall can have unforeseen – and devastating – consequences for these children.

“We received a frantic call from a family for whom we had previously completed an estate plan,” says Robert Smith of Studio City’s SilverTree Special Needs Planning. “A great aunt of the girl with special needs had died and left over $100,000 directly to her. We normally provide notification letters that explain how to leave an inheritance to a loved one with special needs, which would explain that instead of naming the child as the heir, the money should have been left to their Special Needs Trust.”

Money left directly to the girl could have caused her to lose Social Security and Medicare benefits for as long as five years.

How can families of children with special needs provide for their loved ones without jeopardizing the child’s eligibility for government benefits? What about taxes, inflation, and guardianship? What if the child is legally an adult?

Find the Right Advisor

The first step is to find an advisor familiar with the unique circumstances of special-needs families. “Find a qualified planner through referrals from other families or support groups,” Smith says. If possible, find a firm that dedicates its practice solely to special-needs planning and provides comprehensive legal, government-benefits, and financial-needs services.

There are a number of qualified lawyers and financial professionals who specialize in estate planning for children with special needs. While websites such as LegalZoom can also be used to prepare legal documents, estate planning for children with disabilities is far more complex than simply signing a few forms. “Attempting to prepare a special-needs plan on one’s own, or with an inexperienced or unqualified advisor, would be as unwise as trying to extract your own tooth,” says Smith.

Smith advises parents to prepare a list of questions before consulting an estate planner. “You want your planner to be knowledgeable in all aspects of planning, whether or not they are an attorney,” he says. Experts advise against choosing an estate planner based on their fee. A costly plan that works is better than a cheap plan that doesn’t.

What’s In the Plan

Experts recommend that parents of children with special needs set up a Special Needs Trust as the centerpiece of their financial plan.

“Special needs trusts are appropriate in the situation where you have funds set aside for an individual with special needs and you think there may be a possibility you will need those funds managed after you pass on for the benefit of that person,” says Eli Economou of the Economou Law Group in Pasadena.

“Special needs trusts are appropriate in the situation where you have funds set aside for an individual with special needs and you think there may be a possibility you will need those funds managed after you pass on for the benefit of that person,” says Eli Economou of the Economou Law Group in Pasadena.

But this is just one part of a comprehensive plan to secure a child’s care, guardianship, health and income. “Families need to be proactive,” Smith says, and take the following steps:

- Prepare a “Letter of Intent” that provides all of the information that a new guardian or caregiver will need to understand and provide for the child.

- Make a filmed record of any assistance – from bathing and toileting to the basics of communicating – the child requires.

- Appoint Successor Guardians to provide daily care for the child, and Successor Trustees to manage the assets in the Special Needs Trust. These can be the same person or separate individuals.

- Discuss your specific wishes and instructions for your child’s care, and how their needs should be met, with the Successor Guardian and Successor Trustee.

- Take the necessary steps to ensure your child’s government-benefits eligibility will be retained.

- Make a plan for future living arrangements for the child, whether with family members, independently or in a group home.

Make sure that family members know how to properly make gifts or leave assets for the child without interfering with the child’s government benefits.

Special Needs Trusts

As the centerpiece of the plan, the Special Needs Trust will require the most work. “Parents should know that there are various types of Special Needs Trusts that serve specific purposes, and have different ways of being drafted,” Smith says.

There are three types of trusts that parents will likely have to choose from.

The Third Party Irrevocable Living Special Needs Trust: This provides parents with the most flexibility. Once created, the document cannot be amended or revoked, but the trust can be funded immediately. The assets in it aren’t owned by the beneficiary (the child), so they won’t affect government-benefit eligibility. The creator of the trust (usually the parents) serves as the trustee, and can appoint their own successors.

The Testamentary Special Needs Trust: This is typically drafted as part of a will or family trust. However, the Testamentary Trust has limitations – the most important of which is that it cannot be funded or used during the trust creator’s lifetime. These trusts also sometimes give authority to the beneficiary – which can jeopardize the child’s government benefits.

The Pooled Trust: These are established and managed by nonprofit organizations that typically retain a financial firm to invest the funds, which are “pooled” with money from other families participating. Parents and guardians have no control over the trust – including who is appointed as trustees. A pooled trust is a good option for families with few assets to leave a child or no one suitable to be named as a trustee.

Protecting Government Benefits

Any significant sum of money a person with special needs receives has the potential to jeopardize their eligibility for government benefits. To protect benefits, parents should create an OBRA 93 Medicaid Payback Trust, referred to in California as a Disability Trust or Medicaid Payback Trust. “Assets may be transferred from the beneficiary and deposited directly into accounts in the OBRA Trust,” says Smith. This trust helps prevent the return of benefits to Medi-Cal if the trustee either earns too much income or dies.

Extra steps should be taken as a child nears age 18. “The law provides that once an individual turns 18,” Economou says, “they legally are supposed to have the ability to make all their own decisions in terms of money and medical care. If you, as a parent, believe the minor is going to be unable to effectively manage adult life, you should take steps prior to them turning 18.”

Extra steps should be taken as a child nears age 18. “The law provides that once an individual turns 18,” Economou says, “they legally are supposed to have the ability to make all their own decisions in terms of money and medical care. If you, as a parent, believe the minor is going to be unable to effectively manage adult life, you should take steps prior to them turning 18.”

Obtaining a conservatorship of a person with special needs and her or his estate enables the parent to continue legally representing that person for all decision-making purposes. This can be done in Superior Court. Parents should also have an estate planning attorney prepare a durable medical power of attorney so they can legally request confidential medical information about their adult child with special needs.

One additional complication for adult children with special needs is employment. Federal guidelines are extremely strict about how much money someone can earn and still receive government benefits. “If the beneficiary is employed, do not let their income exceed the monthly maximum, which is $1,090 in 2016,” says Smith.

While estate planning for a child with special needs is complicated, the benefits – including peace of mind for the parents and guaranteed income and safety for the child – are substantial. “If we do not achieve this for every family and person with special needs,” Smith says, “then we have failed.”

For Smith’s client with the $100,000 inheritance, quick action was required. The money couldn’t simply be transferred to someone else, or the girl could have lost government benefits. “In addition, Medi-Cal could have claimed a payback from the inheritance, which could have resulted in the entire amount being reclaimed,” Smith says. “We acted immediately. Our legal department created an OBRA 93 Trust, and we deposited the money into that.”

The girl’s benefits continued uninterrupted, and her inheritance was protected. And her parents once again had peace of mind.

Mike Rothschild is a Pasadena-based writer and dad.